As organizations grow through banking M&A, there’s a pressing need to consider both brand and branch implications early in the process.

No matter the strategy, brand and branch change is inevitable and choosing the right partner can define success. Adrenaline leads the industry in guiding financial institutions through mergers and acquisitions, bringing deep expertise to guide smart decision making, reduce risks, streamline integration, and create lasting impact.

We help financial institutions with:

- Scalable, cost-effective strategies for branding and branch conversion

- Pre- and post- transaction due diligence support

- Branch conversion, design, and merchandising expertise

- Culture integration and training

- Communication strategies for employees, customers, and markets

Having led more successful bank and credit union rebrands than anyone in the industry, Adrenaline delivers the precision, speed, and confidence to help your team lead M&A change — and win.

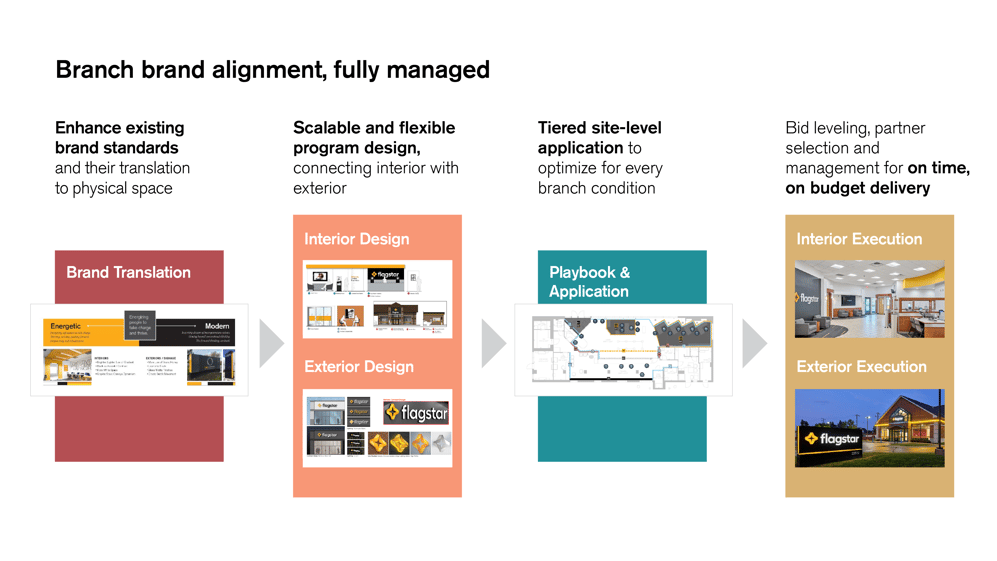

Branch Conversion: Bring Your Banking Brand to Life

The average branch has more than 65 unique interior and exterior elements to change during a rebrand.

Branch rebranding for M&A is so much more than signage. With 60% of exterior and 40% of interior elements that require change per branch, a strategic, coordinated approach to branch rebranding will maximize leverage, minimize cost, and optimize consistency and impact, helping ensure a successful branch investment for M&A.

Our holistic approach to branch conversion ensures that the first 10% of budget spend maximizes the remaining 90% through implementation with services that include:

- Branch audits and surveys

- Interior and exterior branding & signage

- Brand refresh and merchandising

- Environmental graphics & kit-of-parts systems

- Project, program, and construction management

- Cost estimating, value engineering & procurement

- Signage lifecycle management through our AMP Facility Management Solution

From defining scope and recommending design, to overseeing seamless rollout across locations, our in-house experts manage every detail of large-scale bank and credit union branch conversions — on time, on budget, and on brand.

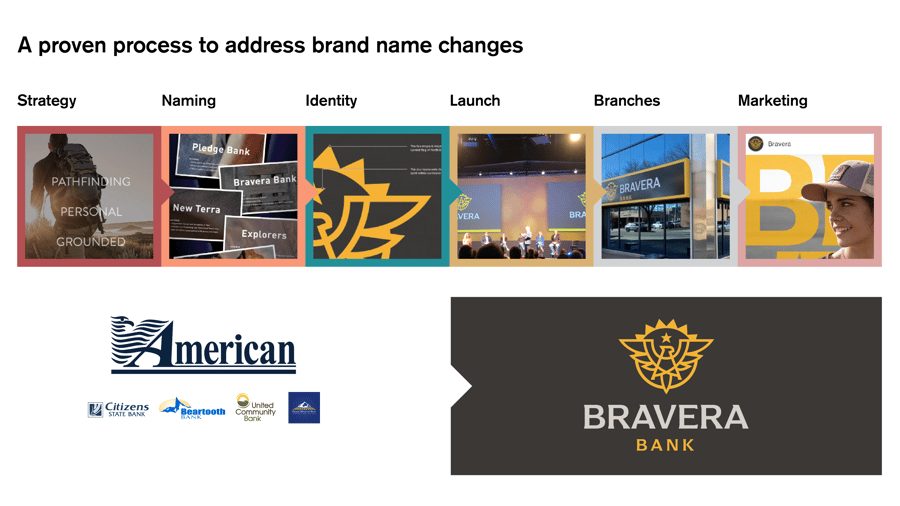

Renaming for Growth: Reignite Your Name and Brand

Research shows that M&A brands with a strong brand strategy have a 42% greater chance of success.

A strategic rebrand or refresh can elevate your financial institution's identity, ensuring relevance in competitive markets — whether navigating M&A or standing out independently.

Merging banks and credit unions must resolve brand name challenges to prevent confusion, avoid legal hurdles in new markets, and establish a unified identity primed for growth.

Adrenaline has guided more financial institutions through renaming, rebranding, and refreshes than any other firm. We craft meaningful brand strategies that align with your vision, turning stakeholders into advocates and unlocking growth opportunities.

Our services include:

- Rebranding & renaming

- Brand strategy and reconciliation

- Brand equity & risk assessment

- Market research

- Employee & culture training

Our M&A specialists guide seamless brand transitions, mitigating legal, reputational, and operational risks at every stage.

We’re big on conversation. Tell us about the challenges you’re facing, the changes you’re pursuing, and the big ideas that keep you up at night. Our experts are here to help.

.png?width=1200&length=1200&name=Flagstar-Troy-0013%20(1).png)